E assim se passaram cinco semanas! Teste pela última vez o seu conhecimento do universo das finanças. Pela última vez, boa sorte!

Confira as suas respostas anteriores no final da página.

1. Labor markets are best described as a type of:

A. capital market.

B. goods market.

C. factor market.

2. The role of the International Organization of Securities Commissions (IOSCO) is best described as:

A. promoting cross- border cooperation and uniformity in securities regulation.

B. enforcing financial reporting requirements for entities participating in capital markets.

C. promoting the use of International Financial Reporting Standards and the convergence of national accounting standards.

3. A company has recently revalued one of its depreciable properties and estimates that its remaining useful life will be another 20 years. The applicable tax rate for all years is 30%, and the revaluation of the property is not recognized for tax purposes. Details related to this asset are provided in the following table:

The deferred tax liability related to this asset (in millions) as at the end of 2014 is closest to:

A. £960.

B. £690.

C. £1,650.

4. Other factors held constant, the reduction of a company’s average accounts payable because of suppliers offering less trade credit will most likely:

A. not affect the operating cycle.

B. reduce the operating cycle.

C. increase the operating cycle.

5. Unlike commercial industry classification systems, industry classification systems developed by governments most likely:

A. are updated more frequently.

B. are more transparent.

C. include private companies.

6. An investor is least likely exposed to reinvestment risk from owning a(n):

A. amortizing security.

B. zero- coupon bond.

C. callable bond.

7. The return measure that best allows one to compare asset returns earned over different length time periods is the:

A. holding period return.

B. annualized return.

C. net portfolio return.

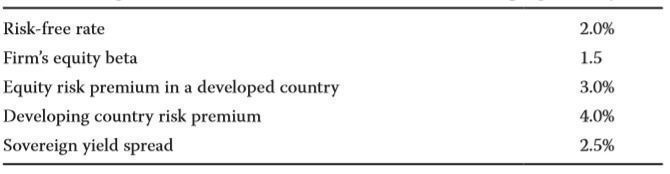

8. The following information is available for a firm in a developing country:

The firm’s cost of equity using the CAPM approach is closest to:

A. 10.5%.

B. 12.5%.

C. 10.3%.

9. A portfolio of securities representing a given security market, market segment, or asset class is best described as a:

A. benchmark.

B. security market index.

C. total return index.

10. The Macaulay duration of a non- callable perpetual bond with a yield in perpetuity of 8% is closest to:

A. 7.4.

B. 8.0.

C. 13.5.

11. Which of the following statements is least accurate concerning differences in the pricing of forwards and futures?

A. Differences in the pattern of cash flows of forwards and futures can explain pricing differences.

B. Pricing differences can arise if futures prices and interest rates are uncorrelated.

C. Interest rate volatility can explain pricing diferences

12. A portfolio has the following returns:

The sample variance of the portfolio is closest to:

A. 0.23%.

B. 0.36%.

C. 0.28%.

--------------------------------------------------------------------------------

1. Monique Gretta, CFA, is a research analyst at East West Investment Bank. Previously, Gretta worked at a mutual fund management company and has a long- standing client relationship with the managers of the funds and their institutional investors. Gretta often provides fund managers, who work for Gretta’s former employer, with draft copies of her research before disseminating the information to all of the bank’s clients. This practice has helped Gretta avoid several errors in her reports, and she believes it is beneficial to the bank's clients, even though they are not aware of this practice. Regarding her research, Gretta least likely violated the CFA Institute Standards of Professional Conduct because:

A. her report is a draft.

B. this practice benefits all clients.

C. the long- standing client relationships are not disclosed.

2. If the distribution of the population from which samples of size n are drawn is positively skewed and given that the sample size, n, is large, the sampling distribution of the sample means is most likely to have a:

A. mean smaller than the mean of the entire population.

B. variance equal to that of the entire population.

C. distribution that is approximately normal.

3. The price index that best resolves the substitution bias is the:

A. Fisher index.

B. Laspeyres index.

C. Paasche index.

4. A company acquired a customer list for $300,000 and a trademark for $5,000,000. Management expects the customer list to be useful for three years, and it expects to use the trademark for the foreseeable future. The trademark must be renewed every 10 years with the Patent and Trademark office for a nominal amount; otherwise it expires. If the company uses straight- line depreciation for all its intangible assets, the annual amortization expense for these two assets will be closest to:

A. $100,000.

B. $600,000.

C. $0.

5. Information about the coupon rates on the various long- term fixed- rate debt issues of a company can most likely be found in the:

A. notes to the financial statements.

B. non- current liabilities section of the balance sheet.

C. Management Discussion & Analysis (MD&A).

6. For a 90- day US Treasury bill selling at a discount, which of the following methods most likely results in the highest yield?

A. Discount- basis yield (DBY)

B. Money market yield (MMY)

C. Bond equivalent yield (BEY)

7. Which of the following statements is most accurate in an efficient market?

A. Active strategies will lead to excess risk adjusted portfolio returns.

B. Securities market prices fully reflect their fundamental values.

C. Securities market prices respond over time to changes in economic information.

8. Which of the following statements is least accurate regarding the factors that affect the interest rate risk characteristics of an option- free bond?

A. The lower the coupon rate, the greater the bond's price sensitivity to changes in interest rates.

B. The higher the yield, the greater the bond's price sensitivity to changes in interest rates.

C. The longer the bond's maturity, the greater the bond's price sensitivity to changes in interest rates.

9. When the futures price of a commodity exceeds the spot price, the commodity market is most likely in:

A. contango.

B. backwardation.

C. carry.

10. A technical analyst observes a head and shoulders pattern in a stock she has been following. She notes the following information:

Based on this information, her estimate of the price target is closest to:

A. $59.50.

B. $48.00.

C. $44.50.

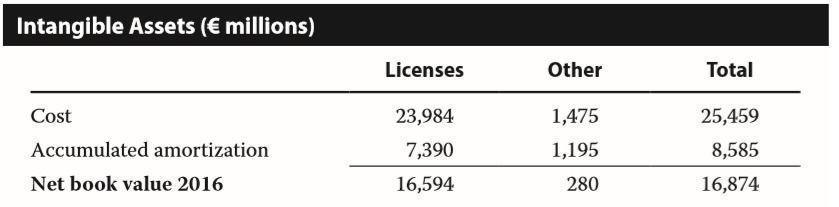

11. The following is an excerpt from the note to the financial statements on intangible assets for a company:

The percentage of intangible assets pledged as security against borrowings in 2016 is closest to:

A. 9.9%.

B. 15.3%.

C. 15.0%.

12. On 1 January, a company that prepares its financial statements according to International Financial Reporting Standards (IFRS) arranged financing for the construction of a new plant. The company

● borrowed NZ$5,000,000 at an interest rate of 8%,

● issued NZ$5,000,000 of preferred shares with a cumulative dividend rate of 6%, and

● temporarily invested NZ$2,000,000 of the loan proceeds during the first six months of construction and earned 7% on that amount.

The amount of financing costs to be capitalized to the cost of the plant in the first year is closest to:

A. NZ$400,000.

B. NZ$630,000.

C. NZ$330,000.